OK Play Share Price: A Deep Dive into the Multibagger Stock

OK Play India Ltd is a prominent player in the plastic products sector, primarily known for manufacturing toys and other plastic goods. The company is publicly traded on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) under the ticker symbol 526415. Here’s a detailed overview of the company’s share price, investor insights, and recent developments.

iphone 17 latest update Click here

1. Current Share Price and Market Performance

As of August 16, 2024, the OK Play share price on the NSE is ₹12.05, reflecting a decrease of 3.56% from the previous close. The stock has experienced a significant decline recently, with a drop of ₹1.73 or 12.55% on that day alone. The company’s market capitalization stands at approximately ₹349.79 crore, indicating its position as a large-cap entity in the market.

Best Laptop for student under 20000 Click here

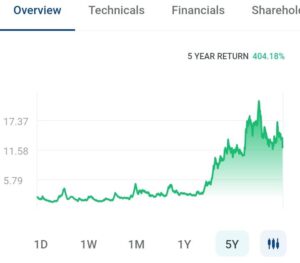

2. 5 Year Return

OK Play share give 404% return in 5 year

These Two girls sell animal online and make 550 crore company Click here

3. 52-Week Performance

The stock has seen considerable fluctuations over the past year, with a 52-week high of ₹21.5 and a low of ₹9.7. This volatility may present both risks and opportunities for investors looking to enter or exit positions in the stock.

Stock is trade near its 52 week lowest value so it can give you a good return in future.

4. Bad News About the Company

This company doesn’t look very good based Here’s why:

1. The stock price is high compared to the company’s assets: This means the stock might be overpriced.

2. The company is struggling to pay its debts: It’s having trouble covering the interest on its loans.

3. The company isn’t making money: It has actually lost money over the past 3 years.

4. The owners have put up a lot of their shares as security for loans: This is risky because they could lose control of the company if they can’t pay back the loans.

5. The company is paying a lot to borrow money: This means it’s spending a lot on interest.

6. The owners are selling their shares: This could be a bad sign as they might not believe in the company’s future.

7. The company is taking longer to turn its sales into cash: This could mean cash flow problems.

Overall, these factors suggest that the company is in financial trouble.

5. Shareholding Structure

The shareholding pattern of OK Play India Ltd reveals that there has been no change in promoter holdings, which remains a positive indicator for investor confidence. However, foreign institutional investors (FIIs) have reduced their holdings by 0.61%, while mutual fund (MF) holdings are minimal at 0.02%. This suggests a cautious approach among institutional investors regarding the stock’s future performance.

6. Recent Corporate Actions

On November 9, 2023, the Board of Directors approved several significant actions, including the unaudited financial results for the quarter ending September 30, 2023, and a proposal to subdivide the equity shares. The existing equity shares of ₹10 each will be split into ten shares of ₹1 each, effective from March 11, 2024. This move is often aimed at increasing liquidity and making shares more affordable for retail investors.

7. Financial Health

The financial metrics for OK Play India Ltd show a Price-to-Earnings (P/E) ratio of 48.2 and a Price-to-Book (P/B) ratio of 2.89. These ratios indicate that the stock may be considered overvalued relative to its earnings and book value, which could be a concern for value-oriented investors.

8. Investor Relations

For potential investors or those looking to learn more about the company, OK Play India Ltd maintains an investor relations section on its official website. This includes important disclosures, financial reports, and contact information for investor queries. The compliance officer, Meenu Goswami, can be reached for further information regarding corporate governance and compliance matters.

Conclusion

OK Play India Ltd presents a mixed bag for investors. While the recent share price decline and institutional selling may raise concerns, the company’s strong brand presence in the plastic products market and upcoming corporate actions could provide opportunities for growth. Investors should closely monitor the stock’s performance, especially in light of the upcoming share split, and consider both the risks and potential rewards before making investment decisions.